Back to featured insights

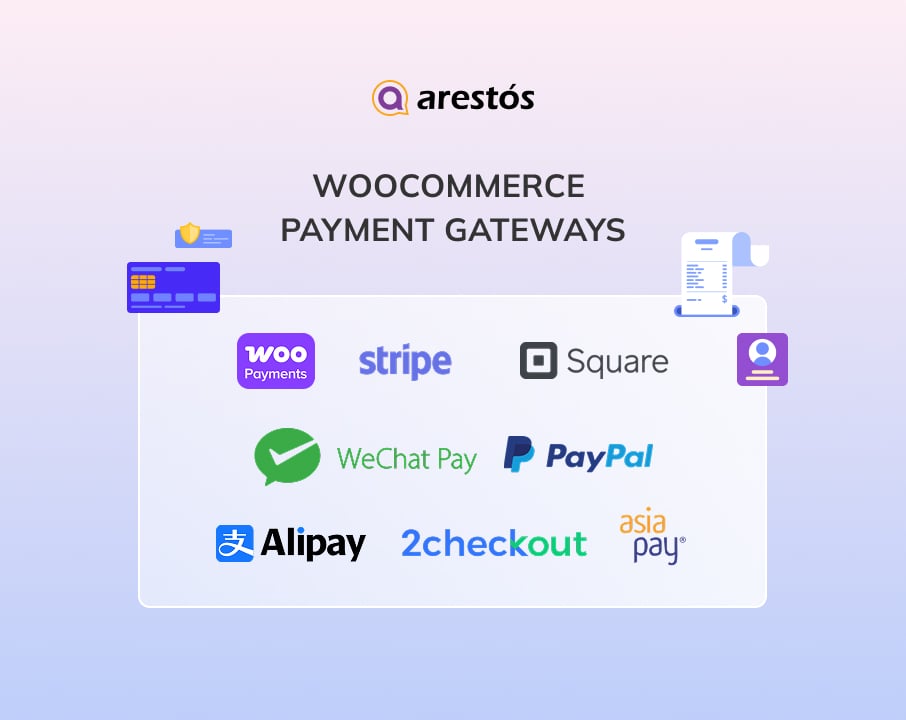

TOP 8 WooCommerce Payment Gateways For Your E-shop in Hong Kong

Choosing the right payment gateway is key to success in Hong Kong's eCommerce scene. Explore 8 top WooCommerce options tailored for local and global transactions. Find out which one best fits your store’s needs and your customers’ payment habits.

Table of Content

Share

Navigating the e-commerce landscape in Hong Kong means offering a seamless and secure checkout experience, and that starts with choosing the right payment solution. In this article, we’ll explore the Top 8 WooCommerce Payment Gateways tailored for online stores in Hong Kong, helping you meet local payment preferences while boosting customer trust and conversion rates.

What Is A WooCommerce Payment Gateway?

In essence, WooCommerce payment gateways are tools, typically plugins or integrated software, that handle the secure transfer of funds from a customer’s bank account or credit card (such as Visa, Mastercard, or Amex) to the merchant’s account.

They simplify and safeguard the online payment process for WordPress-based e-commerce sites, allowing you to sell products or services with confidence while offering your customers a fast, hassle-free checkout experience.

How to Choose the Right WooCommerce Payment Gateway for Your Online Store in Hong Kong

Choosing the right WooCommerce payment plugin requires careful evaluation of multiple key factors. It is important to look beyond just functionality and consider transaction fees, supported payment methods, security protocols, and other critical elements.

Below, we’ll break down each of these considerations in detail:

- WooCommerce Compatibility: Make sure the plugin is compatible with your WooCommerce version. An incompatible gateway can cause payment errors, lost sales, and a poor user experience.

- Free vs. Paid Extensions: Many payment plugins offer free versions or trials with basic features. However, advanced functionality usually comes with monthly or transaction-based fees.

- Payment Gateway Type: There are three types: on-site, off-site, and redirected payments. Each offers different levels of control, costs, and user experience during checkout.

- Customer Location: Ensure the gateway works in your country and the regions where your customers are located. If not supported, it could lead to failed checkouts and lower conversions.

- Supported Payment Methods: Choose a plugin that supports multiple payment options like credit/debit cards, digital wallets (PayPal, Apple Pay), and even cryptocurrency. The more methods offered, the better the chances of completed purchases.

- Ease of Use: The best gateway should be user-friendly for both you and your customers. A clean dashboard and a smooth checkout process help improve the overall shopping experience.

- Transaction Fees: Review all potential fees—monthly charges, per-transaction fees, and chargeback costs. These affect your profit margin and should match your business size and needs.

- Security and Fraud Prevention: Select a gateway with strong encryption (SSL, KYC/KYB) and fraud monitoring tools. Security breaches can compromise customer data and seriously damage your brand.

- Customer Support and Reputation: Look for providers with 24/7 support and clear documentation. Reading real user reviews also helps you understand the pros and cons of each option.

8 Best WooCommerce Payment Gateways for your E-shop in Hong Kong

To make your decision easier, we’ve compiled the 8 Best WooCommerce Payment Gateways that stand out in terms of features, security, and user experience.

- WooCommerce Payments

- Stripe

- Square

- WeChat Pay

- PayPal

- AsiaPay

- 2Checkout

- Alipay

Let’s explore what each one has to offer.

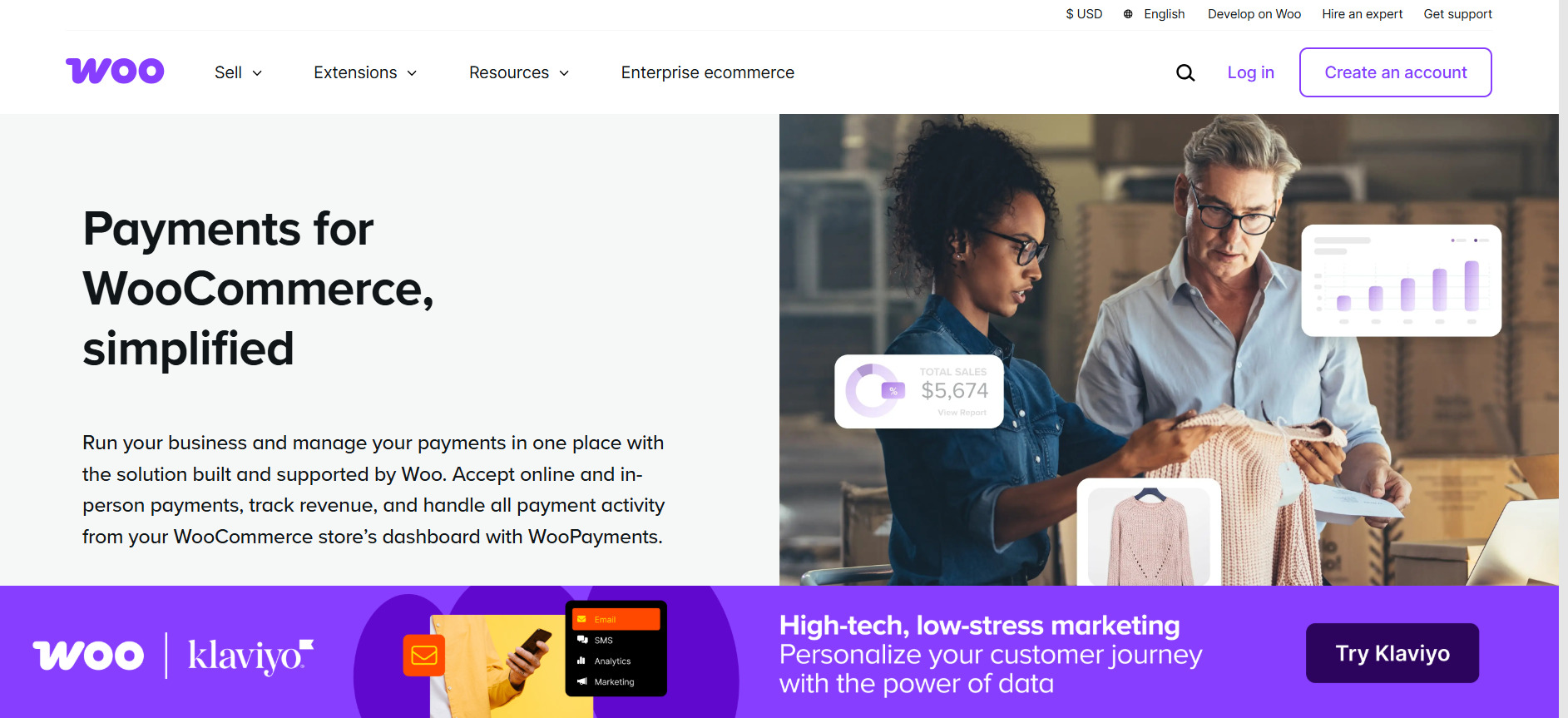

WooCommerce Payments

WooCommerce Payments is the payment solution built by the creators of WooCommerce, designed to provide seamless integration and a centralized management experience for store owners. For businesses in Hong Kong using WooCommerce as their e-commerce platform, implementing WooCommerce Payments significantly simplifies operations.

It allows for the management of transactions, deposits, and disputes directly from the WordPress dashboard, eliminating the complexity of using third-party gateways.

WooCommerce Payments Accepted Payment Methods in Hong Kong

- Card payments: Supports widely used cards such as Visa, Mastercard, and American Express.

- Digital wallets: Allow for express checkout via Apple Pay and Google Pay.

Key features

- Integrated Dashboard: Manage payments, issue refunds, and view detailed reports directly from your WooCommerce dashboard.

- On-Site Checkout: Keep customers on your site during the entire checkout process to increase conversions and reduce cart abandonment.

- Multiple Payment Methods: Accept all major credit/debit cards, along with popular digital wallets like Apple Pay and Google Pay.

- Buy Now, Pay Later: Offer flexible payment options to customers through built-in integrations with services like Affirm, Afterpay, and Klarna.

- Custom Deposit Schedule: Transfer funds into your bank account on a desired schedule—daily, weekly, or monthly.

- Instant Deposits: Access your earnings within minutes, including nights and weekends, for a small fee.

- In-Person Payments: Accept in-person contactless payments using Tap to Pay on compatible devices or with a WooPayments card reader.

- Recurring Revenue: Seamlessly process recurring payments for subscriptions or memberships when paired with the WooCommerce Subscriptions extension.

- Multi-Currency Support: Sell to international customers by displaying prices and accepting payments in various currencies.

Drawbacks

- Does not natively support recurring billing models: To enable subscription-based payments, you’ll need to purchase the WooCommerce Subscriptions extension, which costs $19.92 per month.

- Limited global availability: The service currently does not support merchants in many regions, including Africa, most of Asia, and the broader APAC market.

Read more: Simplified payments for stores in Hong Kong with WooPayments

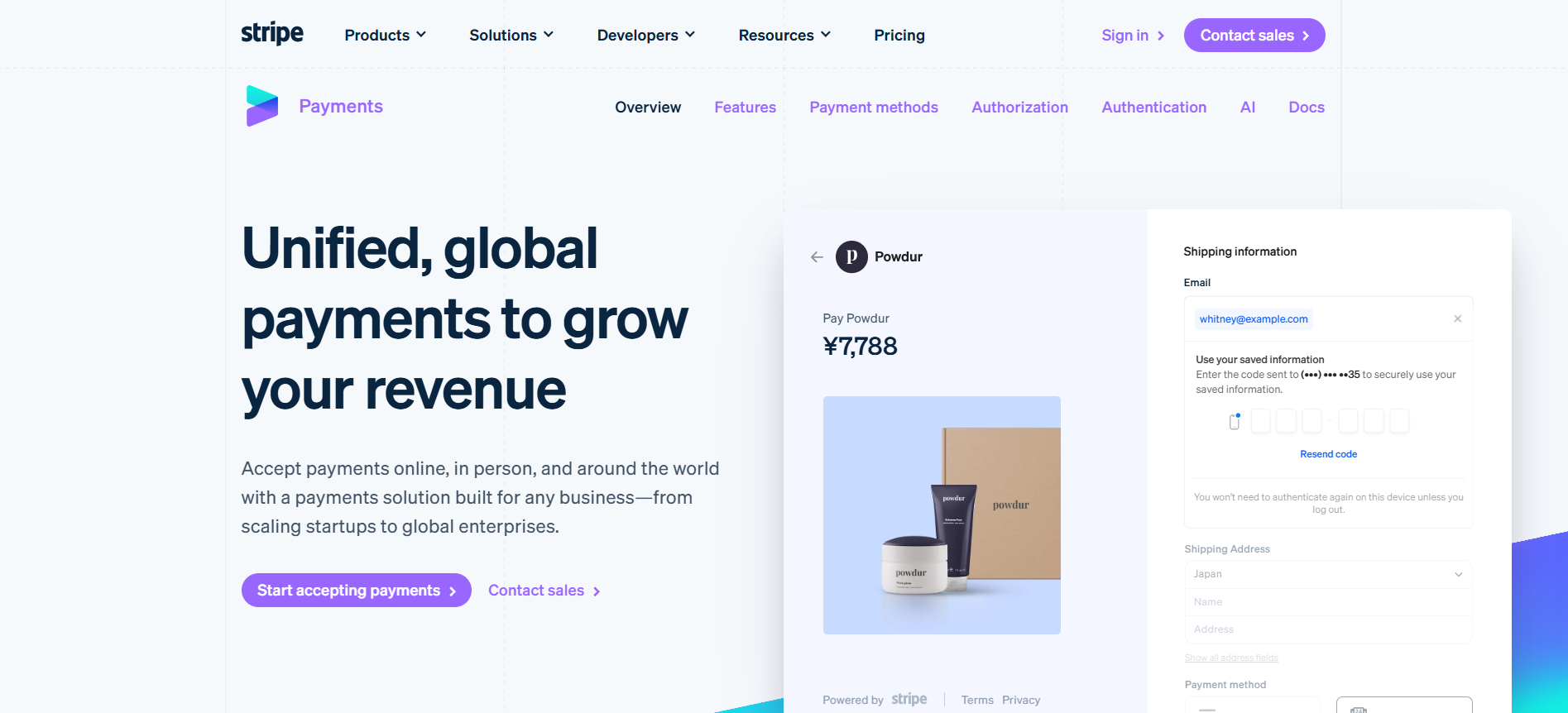

Stripe

Stripe is a developer-first payment gateway renowned for its powerful APIs and flexible infrastructure, enabling businesses to build custom payment experiences. For a vibrant tech and startup ecosystem like Hong Kong, Stripe’s comprehensive suite of tools and deep customizability make it a top choice for businesses looking to innovate and scale quickly.

Similar to other gateways, Stripe supports various transaction types, including one-time payments, subscriptions, and marketplace payments.

Stripe Accepted Payment Methods in Hong Kong

- Credit and debit cards: Accepts major brands like Visa, Mastercard®, JCB, American Express, UnionPay, Maestro, and Link.

- Digital wallets: Compatible with popular options such as Alipay, WeChat Pay, Apple Pay, and Google Pay.

- Bank payments: Enables bank debits, transfers, and instant payments through systems like Bancontact, EPS, iDEAL, and SEPA Direct Debit.

- Installment payments: Offers “Buy Now, Pay Later” solutions through Klarna.

Key features

- Extensive Global Reach: Accept payments from over 195 countries and process more than 135 different currencies, making it ideal for international businesses.

- Comprehensive Payment Ecosystem: Offers a robust suite of tools beyond payment processing, including invoicing (Stripe Billing), fraud prevention (Stripe Radar), and in-person payments (Stripe Terminal).

- Developer-Friendly Customization: Provides powerful APIs and extensive documentation, allowing developers to create fully customized and deeply integrated checkout experiences.

- Wide Range of Payment Methods: Supports a vast array of payment methods, from credit/debit cards and digital wallets (Apple Pay, Google Pay) to popular local payment methods like SEPA, iDEAL, and Alipay.

- Top-Tier Security: Automatically PCI compliant and utilizes its machine learning-powered tool, Radar, to effectively detect and prevent fraudulent transactions.

- Seamless Checkout Flow: Keeps customers on your site throughout the payment process, providing a professional experience and helping to boost conversion rates.

Drawbacks

- Advanced features may require familiarity with APIs: If you’re not comfortable with the technical setup, it may be necessary to bring in a developer for proper configuration.

- Additional services can be pricey: For instance, hosting your checkout on a custom domain comes with a $10/month fee, and setting up a mobile point-of-sale (POS) system can cost $249 upfront.

Square

Square is a comprehensive commerce ecosystem renowned for its ability to seamlessly unify online and in-person sales. For businesses in Hong Kong, particularly retailers, restaurants, and service providers with both a physical and an online presence, Square is an ideal solution. The platform provides robust Point-of-Sale (POS) hardware and payment processing software, all integrated into a single system.

Similar to other payment gateways, Square supports various transaction types, including online payments, in-person transactions, and recurring billing.

Square Accepted Payment Methods in Hong Kong

- Card payments: Supports widely used cards such as Visa, Mastercard, American Express, and JCB.

- Digital wallets: Allow for contactless and online checkout via Apple Pay and Google Pay.

Key features

- Omnichannel Synchronization: Automatically sync sales, inventory, and customer data between your online WooCommerce store and your in-person Point of Sale (POS) system.

- Robust POS System: Offers industry-leading POS hardware and software, allowing you to seamlessly accept payments in-store, at events, or on the go.

- Centralized Inventory Management: Update product quantities in one place (either Square or WooCommerce) and the changes automatically reflect across both platforms.

- Flat, Transparent Pricing: Provides a simple, easy-to-understand pay-as-you-go fee structure with no monthly fees or hidden costs.

- Recurring Payment Support: Allows you to set up recurring invoices and securely save customer card information to charge for subscriptions or post-paid services.

- User-Friendly Interface: Known for its intuitive and easy-to-use interface, making it simple for small business owners to get started and manage their operations.

Drawbacks

- Few complimentary features: Several extensions require separate monthly payments per location, which can add up significantly over time.

- Features locked behind paid tiers: Essential functionalities such as phone support and customer account management are only accessible through the Plus and Premium plans, starting at $29 per month.

Wechat Pay

WeChat Pay, deeply integrated into Tencent’s super-app WeChat, is a powerful payment gateway and e-wallet that enables users to make seamless mobile transactions. Given WeChat’s popularity and the widespread adoption of digital payments, the platform is particularly well-suited for businesses targeting the growing Hong Kong market, where social commerce thrives.

Similar to other payment gateways, WeChat Pay supports various transaction types, including QR code payments, in-app payments, and peer-to-peer transfers.

WeChat Pay Accepted Payment Methods

- Wallet balance (for users with a Mainland China account)

- Linked bank accounts or Chinese-issued credit/debit cards

- QR code transactions, including Quick Pay and Scan-to-Pay

- In-app and web payments through the WeChat Pay interface

Key features

- Ecosystem Integration: Deeply integrated into WeChat, allowing businesses to engage with customers through Official Accounts, Mini Programs, and targeted advertising, driving customer loyalty and sales.

- Seamless QR Code Payments: Enables quick and easy transactions at the point-of-sale and online via QR codes, enhancing the customer experience and reducing checkout times.

- Access to a Massive User Base: Provides access to WeChat’s enormous user base of over a billion monthly active users, offering a significant opportunity for businesses to expand their reach.

- Cross-Border Payments: Supports cross-border payments and multiple currencies, allowing international merchants to sell to consumers and receive payments in their local currency.

- Versatile Marketing Tools: Businesses can leverage WeChat’s built-in marketing tools, such as coupons, loyalty programs, and social media campaigns, to attract customers and boost engagement.

- Robust Security: Employs multiple layers of security, including encryption, transaction monitoring, and user authentication, to protect against fraud and unauthorized access.

Drawbacks

- Dependence on the WeChat Ecosystem: Businesses must have a presence on WeChat (e.g., an Official Account) to fully utilize WeChat Pay’s features, which may require additional resources to manage.

- Complex Setup for International Businesses: The setup process for merchants outside of mainland China can be complex, often requiring work with authorized payment processing partners and adherence to strict regulatory requirements.

- Language and Support Barriers: Similar to other regionally focused platforms, international businesses may encounter challenges with language barriers and receiving timely customer support.

- Primarily Mobile-Focused: The platform is optimized primarily for mobile users, which could be a limitation for businesses whose customers are predominantly desktop shoppers.

PayPal

Alipay, a product of the Alibaba Group, is a comprehensive payment gateway and e-wallet that allows businesses to access a massive consumer base. Given its use by a large volume of mainland visitors and its growing acceptance by local businesses, integrating Alipay is a strategic choice for retailers in Hong Kong looking to capture a significant customer segment.

Similar to other payment gateways, Alipay supports various transaction types, including online and in-store payments via QR codes.

PayPal Accepted Payment Methods in Hong Kong

- Card payments: Supports widely used cards such as Visa, Mastercard®, and American Express.

- Digital wallets: Offers seamless checkout via PayPal Wallet, Apple Pay, Google Pay, and Samsung Pay.

- Pay later options: Includes Pay in 3 or Pay in 4 plans, depending on how the merchant sets it up and where the customer is located.

Key features

- Global Brand Recognition: As one of the most trusted names in online payments, it boosts customer confidence and can improve conversion rates.

- Flexible Payment Options: Offers customers multiple choices, including paying directly from their PayPal balance, credit/debit cards, and “Buy Now, Pay Later” solutions like Pay in 4.

- Express Checkout: Allows customers to bypass entering their shipping and billing information on your site by using the details already stored in their PayPal account, speeding up the checkout process.

- Seller and Buyer Protection: Provides robust protection policies for both merchants and customers, helping to resolve disputes and mitigate fraud risks.

- Simple Integration: The PayPal Payments extension for WooCommerce is easy to install and configure, allowing you to start accepting payments quickly.

- Extensive International Coverage: Supports merchants in over 200 countries and accepts payments in multiple currencies, making it suitable for global stores.

Drawbacks

- Additional charges for cross-border payments: While PayPal facilitates international transactions, it applies extra fees for receiving payments from abroad, including transaction processing and currency conversion costs. These fees depend on the payment method and total transaction value.

- Limited flexibility: PayPal’s standard payment setup may not align with the specific requirements of all businesses. Customizing more advanced functionalities often demands technical expertise or developer support.

AsiaPay

AsiaPay is a leading electronic payment solution provider, specializing in offering businesses a secure, integrated platform to accept digital payments across Asia. Founded in Hong Kong, this gateway is particularly effective for businesses looking to expand into the diverse Asian markets by supporting numerous payment methods and currencies.

Businesses operating in multiple regions can benefit from AsiaPay’s extensive payment network and flexible solutions. Similar to other gateways, AsiaPay supports various transaction types, including installment and recurring payments.

AsiaPay Accepted Payment Methods

- Credit and Debit Cards: Visa, Mastercard®, UnionPay, JCB, American Express, Diners Club, Discover, RuPay

- Digital Wallets: Alipay, AlipayHK, WeChat Pay, BoC Pay, PayMe by HSBC, Octopus Wallet, Apple Pay, Google Pay, Samsung Pay, GrabPay, LINE Pay, ShopeePay

- Buy Now, Pay Later (BNPL): Atome, Grab PayLater

- Bank Transfers & Online Banking: FPS (Faster Payment System)

Key features

- Comprehensive Reach: Supports numerous popular payment methods across various Asian countries and territories, including international credit and debit cards (Visa, Mastercard, American Express), e-wallets (Alipay, WeChat Pay, PayPal), and other local payment options. The platform supports numerous currencies and is multilingual.

- Customizable Checkout Experience: Customers are redirected to AsiaPay’s secure payment page to complete their purchase before being sent back to the merchant’s website. This payment page can be customized to match the business’s branding.

- Advanced Fraud Protection: As a PCI DSS compliant provider, AsiaPay employs advanced security measures like SSL encryption and a real-time fraud detection system to protect sensitive data and mitigate risks. It also offers its ePayAlert service to combat card-not-present fraud.

- Omni-Channel Support: Enables businesses to accept payments across various channels, including web browsers, mobile apps, SmartPOS, and even through social commerce platforms like Facebook, Instagram, and WhatsApp.

- Recurring Payments Support: Offers its “SchedulePay” solution, which allows businesses to automate the collection of scheduled payments (weekly, monthly, annually) for subscription or membership services.

- Easy Integration: Provides APIs and pre-built plugins for seamless integration with popular e-commerce platforms like WooCommerce, Shopify, and Magento.

Drawbacks

- Non-transparent Transaction Fees: Transaction fees are not publicly disclosed and can be relatively high compared to some other payment gateways, depending on the specific merchant plan and agreement.

- Geographic Limitations: While strong in Asia, its global reach is more limited compared to other competitors.

- Complex Admin Interface: The administrative panel can be complex for some new users to navigate.

- Feature Limitations: The availability of certain features may vary depending on the region and merchant plan. Additionally, refund processing is not supported directly within some integrated platforms and must be done through the AsiaPay administration site.

2Checkout

2Checkout (now Verifone) streamlines global payments, providing businesses with an all-in-one platform to accept transactions from around the world. With its strong support for multiple currencies and international payment methods, it is an ideal choice for businesses in a global hub like Hong Kong, enabling them to easily serve a diverse, international customer base.

Businesses operating in multiple regions can leverage 2Checkout’s global reach and flexibility. Similar to other gateways, 2Checkout supports various transaction types, including onsite payments and recurring billing.

2Checkout Accepted Payment Methods in Hong Kong

- Card payments: Supports widely used cards such as Visa, Mastercard®, American Express, JCB, and UnionPay.

- Digital wallets: Offers seamless checkout via PayPal, Alipay, WeChat Pay, and Apple Pay.

- Pay later options: May support installment and alternative financing options, depending on the merchant’s products and agreement with Verifone.

Key features

- Global Reach: Accept payments from over 200 countries and territories with 45+ payment methods, nearly 90 currencies, and 15 languages.

- Inline Checkout Experience: Customers complete their purchase directly on your website without being redirected to the 2Checkout site, creating a seamless and professional checkout flow.

- Advanced Fraud Protection: Leverages advanced fraud detection and protection technology, is PCI compliant, and uses over 300 rules to detect fraud, helping to reduce chargebacks and protect your business.

- Mobile-Optimized: Provides a fully optimized checkout experience for mobile devices, helping to increase conversions from smartphone and tablet users.

- Recurring Payments Support: Compatible with WooCommerce Subscriptions, enabling you to process recurring payments for memberships or subscription products.

- Flexible Payments: Accepts major credit cards, debit cards, and PayPal.

Drawbacks

- Potentially high transaction fees: Transaction fees can be higher than some other payment gateways, especially for small businesses.

- Account stability issues: Some users have reported that accounts can be suddenly frozen without prior warning.

- Complex admin interface: The admin panel can be difficult to navigate for some users, with many options that are hard to locate.

Alipay

Alipay, a product of the Alibaba Group, is a comprehensive payment gateway and e-wallet that allows businesses to access a massive consumer base. Given its use by a large volume of mainland visitors and its growing acceptance by local businesses, integrating Alipay is a strategic choice for retailers in Hong Kong looking to capture a significant customer segment.

Similar to other payment gateways, Alipay supports various transaction types, including online and in-store payments via QR codes.

Alipay Accepted Payment Methods

- Credit and debit cards: Visa, Mastercard®, UnionPay, and JCB

- Digital wallets and Buy Now Pay Later apps: Alipay, AlipayHK, WeChat Pay, GCash, GrabPay, Touch’n Go, Kakao Pay, LINE Pay, ShopeePay, among others

- QR code and bank transfers: PayMe, PayNow, PromptPay, QRIS, and FP

Key features

- Global Reach: Allows merchants to access over 1.3 billion active Alipay users worldwide, while also supporting cross-border payment processing and currency conversion. The platform can handle numerous currencies.

- Integrated Checkout Experience: Customers can pay directly on your website by scanning a QR code generated at checkout. This process reduces manual data entry and speeds up transactions, especially for mobile users.

- Advanced Fraud Protection: Alipay uses advanced encryption and security measures to protect users’ financial information. Its escrow service holds payments until the customer confirms receipt of goods, which helps to minimize fraud risks.

- Mobile-Optimized: Provides a fully optimized checkout experience for mobile devices, helping to increase conversions from smartphone and tablet users.

- Flexible Payments: Accepts payments from linked bank accounts, credit cards, and debit cards.

Drawbacks

- Transaction fees: Merchants may be subject to transaction fees. For example, merchants using Alipay through certain platforms pay a percentage-based processing fee plus a fixed amount based on the currency. However, these fees are often competitive with traditional credit card fees.

- Language and Customer Support Barriers: While English support is available, some documentation and support interfaces may not be fully localized, posing challenges for users in certain regions.

- Regulatory and Compliance Hurdles: Businesses operating internationally must navigate complex Know Your Customer (KYC) regulations and regional data protection policies.

- Limited Acceptance Outside of Primary Markets: Although expanding, Alipay’s acceptance in some international regions is not as widespread as other payment gateways.

Overview of the 8 Best WooCommerce Payment Gateways for Hong Kong Online Stores

Frequently Asked Questions

1. Does WooCommerce have its own payment gateway?

Yes, WooCommerce has its own built-in payment solution called WooPayments. It lets you accept major cards and local methods securely, with no setup or monthly fees, and manage everything right from your WooCommerce dashboard.

2. Why is it important to choose the right WooCommerce payment gateway?

Choosing the right WooCommerce payment gateway is key to secure transactions, customer trust, and a smooth checkout. The ideal option should align with customer preferences, offer strong support, and have fair fees, all of which impact conversions and business growth.

3. Can multiple payment gateways be used in a WooCommerce store?

Yes, WooCommerce supports the integration of multiple payment gateways simultaneously. By providing a range of options such as credit card payments through Stripe, PayPal, and WooPayments, you can accommodate different customer preferences and boost your store’s conversion potential.

4. Do all WooCommerce Payment Gateways support subscriptions?

Recurring payments and subscriptions aren’t natively supported by every payment gateway. Solutions such as Stripe, Authorize.net, and PayPal (when properly configured) are compatible with subscription-based models and can be integrated using WooCommerce Subscriptions or similar extensions. Be sure to confirm this functionality before offering subscription products in your store.

Conclusion

Choosing the right payment gateway can make a big difference in how smooth, secure, and trustworthy your WooCommerce store feels to customers, especially if you’re targeting the Hong Kong market. In this guide, we explored the Top 8 WooCommerce Payment Gateways, breaking down their key features, pros, and potential drawbacks to help you find the one that best fits your business goals and audience.

At Arestós, we specialize in delivering tailored WooCommerce solutions that go beyond basic setup. From payment gateway integration and performance optimization to custom features and scalability, our team ensures your store is not only functional but ready to convert.

Contact us today to find out how we can help you build a faster, safer, and smarter eCommerce experience.

Subscribe to our newsletter!

Get updated to

the lastest IT trends